The South Korean project called Fantom started to gain popularity in the European market in 2021, although it was already known in Asia. Its goal is to solve the blockchain trilemma: how to maintain decentralization and security, while tackling the scaling problem. Our in-depth analysis of this cryptocurrency, which works in Opera’s own network, will reveal all the nuances of this project and give an assessment of its prospects.

- 1. FTM cryptocurrency history

- 2. Features

- 3. What is FTM cryptocurrency in simple terms

- 4. Characteristics

- 5. Working principle

- 6. Transaction speed

- 7. Distinctive features

- 8. Number of coins in circulation

- 9. FTM cryptocurrency technology

- 10. Coin issuance

- 11. Collateralization

- 12. Usage

- 13. FAQ

- 14. Advantages and disadvantages of the Fantom platform

FTM cryptocurrency history

In 2018, the South Korean fund named “Fantom FounDAtion Ltd” was established. Its head was Professor Ahn Byung Ik. He is known as the CEO of the popular cafe and restaurant review app SikSin, and as the president of the “Korea Food-Tech Association”.

The main project overseen by the fund is the “Fantom” blockchain. The developers described their brainchild the following way: “This is the first platform for generating smart contracts, decentralized DApps and tokens that solves the problem of low transaction speed and scaling”.

The blockchain project will be managed by the “Fantom FounDAtion” fund, network validators and delegates since the fall of 2021. However, the creators imply that Fantom will become even more decentralized in the future, and the influence of the foundation will diminish over time.

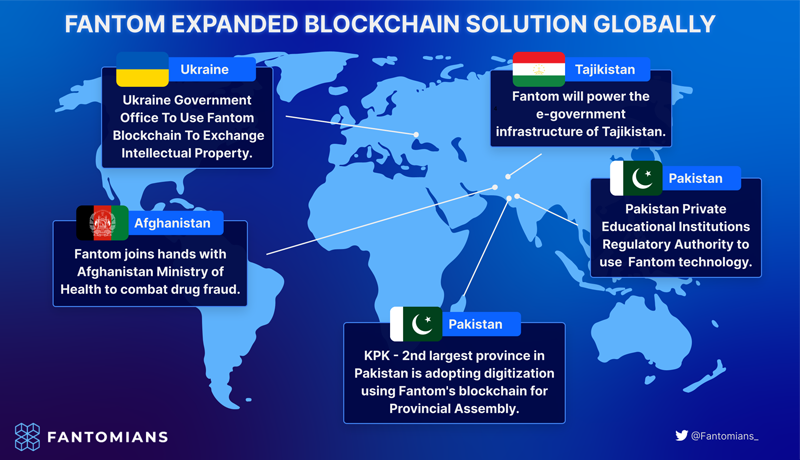

The company’s initial goal was to work with large organizations and government agencies, mostly based in South Korea. The first partners were involved in food production, preparation and distribution. A shift in strategy followed, with the foundation moving to the Cayman Islands, where the team began to do much more international business. At about the same time, a large number of international partners appeared who wanted to make use of the decentralized financial instruments of DeFi.

The leadership of the project also changed at that time:

- Michael Kong – CEO and IT Director. He graduated from the University of Sydney with a degree in Information Technology. He is known for many projects: once he was a director at Aiziko (software development company), then at myStake (IT company) where he developed a stock and dividend management application. At Block8, he developed DApps on blockchain.

- Quan Nguyen – CTO. He studied at 2 universities: New South Wales and Sydney, earning a postgraduate degree in computer programming and a PhD in graphic design.

- Andre Cronje – DeFi Architect. He graduated in Law from Stellenbosch University and then studied Information Systems at CTI Education Group. He is best known for creating the protocol for making money on DeFi called “Yearn”.

There were several successive periods and stages of fundraising for the project. Thus, in the early stages, the project was backed by major venture funds such as Arrington XRP Capital, JRR Crypto, Hyperchain Capital and others. See the table for more details:

| Type of funding | Dates | Percentage of distributed coins out of total market supply | Price per 1 FTM | Amount collected |

| Early investors | February-March 2018. | 3,15% | $0,016 | $1.6 million: 613,514 USD + 130,000 AUD + 1386 Ethereum |

| Private Sale 1 | March-May 2018. | 25,35% | $0,031 | $24.8 million: 3.238 mln USD + 32,265 Ethereum |

| Private sale 2 | May-June 2018. | 11,69% | $0,035 | $12.9 million: 700 thousand USD + 19,780 Ethereum + 8 BTC |

| Public tokensale (ICO) | 15 June 2018. | 1,57% | $0,04 | ~$2 million: 4317 ETH |

| Total: | 41,76% | ~$39.65 million |

The remaining FTM units were distributed as follows:

- Project team – 7.49%.

- Consultants – 12%.

- Reserves – 6%.

- Block creation rewards – 32.75%.

Most (32.75%) of the coins were reserved for rewards for users who keep the blockchain running

The test network was launched in December 2018 and the main network was deployed on December 27, 2019. Other significant events are shown in the table below:

| Period | Steps in project development |

| Q3 2019. | Establishing partnerships with companies in Dubai.

Creating a document describing the operation of virtual machines running smart contracts. This is the first step in solving the problems of scaling, speed and price of operations. Preparing a document on the network management system. |

| Q4 2019. | Providing access to the company’s technologies, consulting with the companies from Dubai.

Establishing partnerships in the Middle East and Southeast Asia. Creating a compiler specification for the virtual machine. Publishing a document describing the requirements for the JavaScript API. Introducing the ability to run non-validating nodes from mobile devices that synchronize with the network, send and receive transactions, but do not participate in validation and consensus processes. |

| Q2 2020. | Establishing a board to develop and deploy the project’s technologies.

Opening the environment to developers. Establishing an agency to support the project’s research. Updating the system architecture Launching an open logistics application service. |

| 2021 | Creating a program to fund projects that accelerate the growth of the network. In June, 9 startups got funded, including: SpiritSwap (automated market maker for fast trades), Cryptokek (a tool for charting and analysing crypto portfolios), Coordinape (a service for DAO to distribute bounties to contributors).

Creating a program for developers of decentralized financial instruments DeFi. The fund allocated 370 million units of Fantom cryptocurrency for this purpose. In October, a subprogram was launched to incentivize developers of blockchain-based gaming platforms (GameFi). Announcing the launch of the TUSD stablecoin backed by the US dollar and partnering with Tajikistan’s Orienbank to launch the country’s national cryptocurrency (CBDC). |

Features

Fantom is a fast and 100% open blockchain platform with smart contracts. It is designed to:

- Create a unified infrastructure for fast transactions and online data exchange across disparate (and previously incompatible) platforms and tools.

- Offer a variety of opportunities for the telecommunications, electric vehicle manufacturing, logistics, and financial industries.

- Create decentralized DApps.

- Create coins and other tokenized assets.

The platform is powered by a distributed ledger based on the Directed Acyclic Graph (DAG). It is hailed as the next step in the evolution of blockchains, creating a brand-new type of structure without blocks and miners.

By using DAG and the aBFT consensus principle, the project solves the trilemma of scalability, decentralization, and security all at once. Thanks to this and the launch of the grant program, the project’s ecosystem has begun to grow rapidly.

In October, the total amount of funds held in Fantom-based DeFi protocols (TVL) exceeded $5 billion. In November 2021, the ecosystem ranks 7th among all other ecosystems. The first three are Ethereum, Binance and Solana.

The table below shows the decentralized applications released on the project network:

| Segment | Most popular DApps |

| Exchanges without a DEX governing body | SpookySwap, Curve, Beethoven X, KyberDMM |

| Optimizer services for passive earning | Beefy, Yearn, Reaper.Farm, Grim, Tomb Finance |

| Wallets | fWallet |

| Decentralized bridges between blockchains | Multichain, SpookySwap, REN, Xpollinate |

| Platforms for NFT transactions | Artion, ZooCoin, PaintSwap |

| Lending and borrowing applications | Geist, Scream, Tarot, Abracadabra |

| Other tools | Debank, Zapper, APY.Vision, Defillama |

What is FTM cryptocurrency in simple terms

The project launched the Opera core network, which provides support for smart contracts and is fully compatible with the Ethereum blockchain. The FTM cryptocurrency is its native service coin, which is required to maintain operations and security through a stacking process.

The coin is issued on both the main Opera network and the Ethereum and Binance Smart Chain blockchains in ERC-20 and BEP2 token format respectively.

Characteristics

The parameters of the coin are shown in the table below:

| Characteristic | Value |

| Place in the rating on Crypto.ru in November 2021 | №26 |

| Position in the top on CoinMarketCap | №35 |

| Circulating supply | 2.55 billion coins |

| Maximum price (This information is current as of November 2021) | $3.48 (28 October 2021) |

| Minimum price (This information is current as of November 2021. | $0.001935 (13 March 2020) |

Working principle

The underlying technology of the Fantom platform is the Opera decentralized network. It can process transactions at lightning speed and scale, outperforming many other blockchains. The chain consists of 3 layers:

- Core (transaction processing).

- Ware (memory to support smart contracts and other features).

- Application (applications for DApps running on the network).

The basic layers are: core, ware, application; they are based on the acyclic graph DAG.

The table below is a summary of the elements that are part of the core layer:

| Parts | Explanation | Structural elements |

| Infrastructure | Provides continuous and secure transmission of data between entities using the network, including tools for sending information and detecting errors. | Data flow control

Error management |

| Control | Verifies that the calculations for specific transactions, smart contracts, validator rewards, and others are correct. That is, the mechanism checks all operations performed at the computation layer and then displays the data at the infrastructure one. | Network congestion monitoring

Display |

| Computation | Executes and manages operations, smart contracts, data from DApps, and analyzes traffic from the management layer. It oversees error checking of operations and ensures unbiased, fast data processing. It also provides network optimization and scalability. | Computing protocol

User datagram protocol (blocks of information transmitted by the protocol through the network) |

| Interface | Provides the environment in which each DApp gains access to the network. Manages and monitors accounts, validates addresses, and checks transaction signatures to ensure that authorized data can flow to the compute layer. Ensures that all tiers and layers, including the kernel, interact with storage. | Accounting

Authentication Authorization |

The ware layer includes:

- An open source API.

- Smart contract writing scripts

- Wallets for cryptocurrencies.

- A programming language.

- Middleware for DApps.

The ware layer allows network participants to receive rewards in native system coins.

This layer uses 5 interconnected protocols to operate: Transaction, Reward, Story Data, Reputation and Smart Contract. The latter is the key link through which all elements interact.

Key elements for network operation.

How the interaction occurs:

- The repository authorizes transactions between participants by interacting with the protocol.

- The Story Data protocol collects information about each party’s actions (smart contracts, reputation points, rewards) and maintains previous data.

- The repository verifies and consistently updates the scores of each transacting party through the Reputation protocol.

- The Reputation protocol works in conjunction with the Rewards protocol to ensure that each participant earns winnings commensurate with their Reputation points.

- Following the logic of smart contracts, the repository initiates the execution of transactions between parties based on records of their transactions and reputation scores. This is done using a Story Data protocol.

The “engine” that drives the entire infrastructure is the consensus algorithm of aBFT’s asynchronous Byzantine Fault Tolerance – Lachesis. It has been developed by the project team.

Compared to other consensus methods, the Lachesis mechanism is faster, more secure, and more scalable.

Transaction speed

One of the benefits cited by developers is high throughput. Transaction completion (the state of the network when a transaction can no longer be modified or returned) is achieved in 1 second. This is very fast. It allows users to perform transactions almost instantly.

In comparison, the Bitcoin blockchain takes an average of 10 minutes to complete a transaction, while Polkadot’s high-speed network takes between 2 and 5 seconds.

The developers originally said that performance would reach a record 300,000 TPS. However, they have since lowered their expectations. In the test network, a maximum of 10,000 TPS was reached in 2020. Meanwhile, the figure for MainNet Opera in the fall of 2021 was 4,500 TPS. However, considering that the average speed of Bitcoin is 7 tx/s and that of Stellar is 1,000 tx/s, this is still a very high number of transactions processed per second.

But some users are concerned that such high throughput comes at the expense of high centralization. After all, in November 2021, there were only 47 active validators on the network.

Distinctive features

Here are the features of the Fantom blockchain and its native coin:

- Instant transactions – transaction takes 1 second. Fees are minimized. The DAG registry is suitable for micropayments.

- Scalability – excellent transaction speed enables processing of 1000 or more operations per second and supports high performance distributed applications. Up to 1000 nodes can be connected to the network.

- Simple yet reliable security – a Proof-of-Stake (PoS) network operates without a leader and does not require any trust between the participants.

- Combability with the Ethereum Virtual Machine (EVM), which consists of individual nodes. This allows decentralized ETH applications to run on the Fantom network.

- The native coin is used for administrative purposes. It is issued not only in the main project network, but also in other blockchains: Ethereum and Binance Smart Chain, for example.

Number of coins in circulation

There are currently 3,175,000,000,000.00 FTM coins in circulation.

FTM cryptocurrency technology

The developers created their decentralized, distributed data registry based on an acyclic graph. This is an atypical network that has no classical blocks. The programmers have also developed their own consensus algorithm, called Lachesis.

Other technologies include:

The fWallet – it is designed as a Progressive Web Application (PWA) and runs on both desktop and mobile devices. Supported operating systems are Windows, macOS, Linux, iOS, Android. It opens access to DeFi, so it is possible to start trading immediately and participate in stacking, lending or borrowing procedures.

One of the project’s most popular technologies is fWallet.

FTMScan and Opera Explorer. These are tools that allow to track transactions, blocks, node activity in the network. All statistics are displayed in online mode.

Capitalisation

$953 452 500,00

Coin issuance

The total supply of cryptocurrency is limited to 3.175 billion units. Additional generation of FTM is not possible. In November 2021, there are 2.55 billion coins in circulation (about 80%). The rest are reserved for rewards.

Holders can vote to change the number of coins paid to validators. However, if this does not happen, all units of the cryptocurrency will come into circulation in 2023-2024.

When calculating the issuance, FTMs issued on all networks (including the Ethereum and Binance Smart Chains) are taken into account. The total limit cannot be exceeded by generating tokens on other blockchains.

Collateralization

Like most other cryptocurrencies, FTM is highly volatile because it has no real backing. This means that it is not supported by gold or any other form of reserve. Limited issuance has been introduced to prevent devaluation and create the conditions for a rising exchange rate. The support of a large fund “Fantom Foundation”, leading cryptocurrency exchanges and institutional investors interested in the project’s technology are other guarantors of relative price stability.

Usage

As intended by the platform creators, FTM can be used in the following ways:

| Purpose | Explanation |

| To ensure network security | Opera uses a proof-of-stake (PoS) mechanism and an asynchronous Byzantine Fault Tolerant (BFT) consensus algorithm. Node validators and stackers block FTM cryptocurrency in their accounts to keep the network running. They are also rewarded in native platform coins for doing so. |

| To implement payments | Both individual owners and large companies can use the coins for transfers. Money transactions take 1 second due to high throughput and the average commission is only $0.0000001, so it is viable. |

| For management decisions | Decisions about changes are made by validators and stack delegates. Voting is transparent and takes place within the network. And with all this, 1 FTM still equals 1 vote. |

| To pay network fees | Fees for transactions, running new protocols, and deploying smart contracts are paid in native system coins. Minimal fees are necessary to protect the network from spam transactions that would fill the distributed ledger with unnecessary information and reduce its productivity. The fees are small, but enough to make it expensive for exploiters to attack the blockchain. |

Also, this cryptocurrency would be suitable for trading or long-term investment as its price is volatile.

FAQ

What is special about the Lachesis consensus mechanism?

The peculiarity is that transactions are confirmed in 1-2 seconds, all participants are equal (there are no users with special privileges), and command processing can take place at different times. Byzantine Fault Tolerance is also supported.

Can coins that are involved in stacking be used?

No, they need to be cashed out first. The process takes an average of 7 days – if no hold period is specified.

Can I lose coins while stacking?

Yes, it is possible to lose coins if you encounter a dishonest validator who acts maliciously, ignoring the interests of the system and other users. Therefore, it is important to choose a node with a good reputation.

What does the Byzantine Resilience Mechanism provide?

It allows the network to function properly even if one-third of the nodes fail and validate transactions incorrectly.

Advantages and disadvantages of the Fantom platform

Advantages:

- High scalability and throughput

- Suitable for micropayments as fees are minimal

- Open environment for developers

- Advantageous grant programmes for DeFi creators

- Stacking with flexible terms

Disadvantages:

- Limited number of validators until the fall of 2021, suggesting that the project is poorly decentralized, but developers have plans to change that

- The development environment is less popular than Ethereum

- Low popularity of the coin in the media. Little data available to make long-term predictions.